Filing income tax returns always brings various confusion among the individual due to new norms and digitised processes. Filing and paying advance tax is one of them. In this article, we will deeply go through the stepwise process of advance tax payment.

Filing income tax returns always brings various confusion among the individual due to new norms and digitised processes. Filing and paying advance tax is one of them. In this article, we will deeply go through the stepwise process of advance tax payment.

Advance tax is the part of the tax that you pay before the end of the financial year. It is a way of paying tax as you earn. It helps you in reducing the burden of paying a lump sum amount in one go and also helps the government to maintain a regular flow of income throughout the year.

If you are earning an income other than the head of the salary, such as interest income, winning from the lottery, etc., you need to pay advance tax only if your tax liability exceeds ₹10,000. In the case of salary income, TDS will be deducted by your employer itself.

Let’s go through the stepwise process of paying advance tax in India.

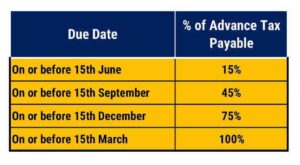

The very first step of the advance tax payment process should be calculating your income tax liability, to see whether your income tax liability is exceeding the limit of ₹10,000 or not. If yes, then only you have to pay tax by the following due dates:

| Due dates | Rate of advance tax |

| On or before 15th June | Up To 15% of the advance tax liability |

| On or before 15th September | Up To 45% of the advance tax liability |

| On or before 15th December | Up To 75% of the advance tax liability |

| On or before 15th March | 100% of the advance tax liability |

Now, that you have sorted out all the calculations, you need to visit the website by clicking below:

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

As you are paying advance tax by self-assessment, you have to click on Challan number 280. Self-assessment means you are paying taxes by identifying your tax responsibilities on your own, no government authorities issue a notice to do so.

You will see the page on which you have to fill out the required details in the online form. You will see the tax applicable, type of payment, mode of payment, permanent account number (PAN), assessment year, contact details, and captcha to let the computer know that you’re a human.

Many taxpayers make the mistake of filling out an assessment year. The assessment year is the following year of the financial year (in which you have earned the income). For example, if you have earned income in the year 2022-2023, your assessment year will be 2023-2024.

Before the actual submission of your advance tax, you need to check out if any detail is misfiled. If everything is filled in correctly, you can process further and tick on the “I agree” option to complete the submission.

For making an actual payment, you need to log in to the bank account to finalise the payment. You need to approve the payment and select the mode of payment at which you are choosing to pay. Basically, there are only two options for making payments, net banking and through debit cards. Make payment by clicking on the submit button.

Making payment of taxes is becoming easier due to the digitised services of the authorities. All you need to do is fill out all the details carefully as it will be a tiresome process for you to file a revised return.

Source: https://mintgenie.livemint.com/news/personal-finance/income-tax-how-to-pay-advance-tax-online-here-s-a-step-by-step-guide-151671451729155

© 2018 CA Chandan Agarwal. All rights reserved.