Pre-validation will make it possible for the Income Tax Department to deposit any tax refund in your bank account.

Pre-validation will make it possible for the Income Tax Department to deposit any tax refund in your bank account.

Income Tax Return Filing: People have started filing their ITR. The last date to file the ITR timely for FY 2022-23 is July 31. In the midst of accounting for all your payslips, deductions and other financial data, one thing can skip your mind- pre-validating your bank account. If you forget to pre-validate your bank account before filing ITR, you may not receive any tax refund. Scroll down to know everything about how to pre-validate your bank account.

Why is it important to pre-validate your bank account before filing ITR?

It is essential to pre-validate your bank account before you start the process of ITR filing. Pre-validation will make it possible for the Income Tax Department to deposit any tax refund in your bank account.

“A pre-validated bank account may also be used by the individual taxpayer for enabling EVC (electronic verification code) for e-Verification purposes. E-Verification can be used for Income Tax Returns and other Forms, e-Proceedings, Refund Reissue, Reset Password and secured login to e-Filing account,” a notice on I-T Department’s website reads.

For pre-validation purposes, you must have a valid PAN linked with your bank account. The PAN must be linked with the e-Filing facility of the Income Tax Department.

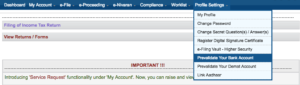

How to pre-validate your bank account?

Once you complete the process, the validation status will be sent to your registered email ID and mobile number. In case the process fails, you can re-submit your account for pre-validation.

Once you submit the request for –pre-validation, it is automatically sent to your bank. The status will be updated in your e-Filing account within 10 to 12 working days.

Steps to check pre-validation status:

Source: https://www.news18.com/business/tax/itr-filing-pre-validate-bank-account-on-income-tax-website-7764847.html

© 2018 CA Chandan Agarwal. All rights reserved.