If your tax liability for the year is more than ₹10,000, then you must pay 15 percent of yearly income tax before June 15, as per the provisions of advance tax.

If your tax liability for the year is more than ₹10,000, then you must pay 15 percent of yearly income tax before June 15, as per the provisions of advance tax.

As the first quarter of the current financial year is about to end in a few days, taxpayers are supposed to pay advance tax on their earnings for this quarter before June 15.

Although income tax is meant to be paid in advance in order to avoid the late charges, the salaried individuals are often a relaxed lot since their employer invariably deducts the tax component before disbursing the salary in the bank accounts of employees every month.

The Income Tax Act, under section 208, mandates that every person whose estimated tax liability for the year is ₹10,000 or more, will have to pay tax in advance.

Under provisions of advance tax, one has to pay a minimum of 15 percent of total income tax for the year before June 15.

Likewise, 45 percent of total tax for the year should be paid before December 15, as shown in the table below.

Advance tax is a system of paying income tax in instalments throughout the year, rather than in a lump sum at the end of the year.

It is meant for individuals and businesses whose estimated tax liability for the year is Rs. 10,000 or more.

It is vital to mention here that professionals who opt for presumptive taxation schemes do not need to stick to this timeline of advance tax. They, however, are supposed to pay 100 percent of advance tax before March 15 of the financial year.

Freelancers: If you are a freelancer and your total income for the year is more than Rs. 10,000, you will be required to pay advance tax. You will need to calculate your own tax liability and pay it to the government in instalments.

Businesses: If you own a business and your total income for the year is more than Rs. 10,000, you will be required to pay advance tax. You will need to calculate your own tax liability and pay it to the government in instalments.

Non-Resident Indians (NRIs): If you are an NRI and you have income accruing in India, you may be required to pay advance tax. The amount of advance tax that you need to pay will depend on your total income and your residency status.

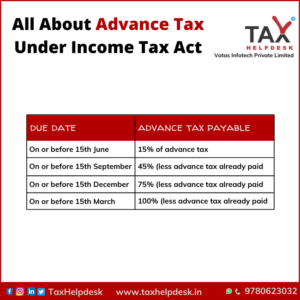

The due dates for advance tax payment for self-employed individuals are:

| Date | Proportion of advance tax to be paid |

| June 15 | 15% of the estimated tax liability for the financial year. |

| September 15 | 45% of the estimated tax liability for the financial year, less the amount already paid on or before 15th June. |

| December 15 | 75% of the estimated tax liability for the financial year, less the amount already paid on or before 15th June and 15th September. |

| March 15 | 100% of the estimated tax liability for the financial year, less the amount already paid on or before 15th March. |

If the taxpayer fails to pay the advance tax in full by the due date, they will be liable to pay interest at the rate of 1 percent per month on the amount that is outstanding. The interest is calculated from the due date until the date on which the tax is paid in full.

Here are the steps on how to pay advance tax online:

To sum up,if you are a taxpayer who is supposed to pay advance tax, it is important to make sure that you understand the rules and regulations that apply. You should also make sure that you pay the correct amount of advance tax on time. If you have any questions, you should consult with a tax professional.

Source: https://mintgenie.livemint.com/news/personal-finance/income-tax-pay-the-first-instalment-of-advance-tax-before-june-15-to-avoid-penalty-151686285965211

© 2018 CA Chandan Agarwal. All rights reserved.