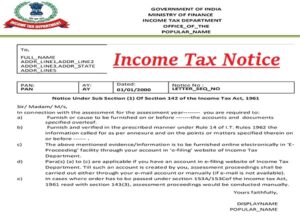

The Income Tax Department issues an income tax notice for a number of reasons under a number of provisions.

The Income Tax Department issues an income tax notice for a number of reasons under a number of provisions.

The Income Tax Department issues an income tax notice for a number of reasons under a number of provisions. Normally, a taxpayer receives an income tax notice as a result of missing or filing their income tax return late, filing it incorrectly, claiming an incorrect tax refund, and many other reasons. The income tax notice is issued by the tax department under sections 143(1), 142(1), 139(1), 143(2), u/s 156, Section 245 and Section 148. Here are the top reasons a taxpayer may receive an income tax notice, based on an exclusive interview with several industry experts.

Getting an income tax notice can be stressful. These notices can be issued for various reasons – from as obvious as failing to file an income tax return or a delay, to calculation errors to a request for specific information pertaining to your filings or reporting excessive losses.

Here are some of the common reasons why taxpayers receive an income tax notice:

a) Mismatch in TDS amount: When the TDS claimed in the Tax return doesn’t match with Form 26AS and 16 or 16A.

b) Mismatch in income: Whenever there is a discrepancy between the income tax return and form 26A.

c) Discrepancy in tax returns: There are times when taxpayers make common mistakes like claiming deductions under the wrong sections, or unintentionally failing to add their interest, rent, dividend, or other incomes in their calculations. Such instances will create discrepancies in their tax returns and what they are actually liable to pay and will invite income tax notice.

d) Discrepancies in disclosure of declared income versus your actual income: This is an obvious one. The income tax department is constantly on the lookout for people trying to evade taxes. If the IT authorities suspect that you haven’t disclosed all your income from various sources, then you could be served with an income tax notice.

e) Failing to report high-value transactions: The Income Tax Department requires taxpayers to report all their high-value transactions, so they can curb black money and detect all under-reported income. In case, you fail to report such transactions then this will invite an IT notice. Examples of high-value transactions include cash deposits or withdrawals over ₹10 lacs, international transactions in foreign currency over ₹10 lacs, and purchase of mutual funds, bonds, or debentures of over ₹10 lacs.

f) Random scrutiny: If you’re unlucky, you could receive the notice because every year, the IT department randomly selects the files for which IT returns need to be scrutinized. If you have paid your taxes diligently and have all the paperwork in order, you have nothing to worry about.

g) Incomplete documentation: Many times, your income tax returns need to be accompanied by some required documentation. If you fail to provide these, then you will receive a notice. These include but are not limited to: your balance sheet and profit and loss statement in case the net profit from your business income or profession exceeds ₹1.2 lacs, Form 67 if you have received any foreign income and Form 10E in case of arrears.

Some of the reasons due to which taxpayers may receive income tax notice are as follows:

1) Taxpayers not filing their income tax returns irrespective of their total income exceeding the basic exemption threshold or otherwise being eligible for filing such return

2) Mismatch in the income details as per the returned income and Annual Information Summary (AIS)/ Tax Information Summary (TIS)/ Form 26AS

3) Taxpayers have claimed excess TDS than what is reflected in Form 26AS

4) Discrepancy in the calculation of interest u/s 234A/B/C as per the returned income and as per the revenue authorities records

5) Missing out disclosing certain income or failing to apply clubbing provisions

6) Selection of wrong ITR form leading to a defective return

7) Any high value or unusual transaction which is not commensurate with other details of the returned income

There are several reasons why you may receive an income tax notice from the government. One common reason is if you have not filed your tax returns on time or have filed them incorrectly. Another reason could be if there are discrepancies in the information you have provided, such as mismatches in your income or expenses.

Additionally, if you have claimed excessive deductions or exemptions or have not disclosed all your income sources, you may be flagged for further scrutiny. In some cases, if you have received a high-value transaction or made significant investments, the government may also ask for clarification on the source of funds.

It is essential to maintain accurate and complete records of your financial transactions to avoid receiving an income tax notice. In case you do receive a notice, it is important to respond promptly and provide the necessary documents and information to the authorities.

There are several reasons why you may receive an income tax notice, including:

a) Mismatch in reported income: If there’s a discrepancy between the income reported in your tax return and the information available to the tax authorities (e.g., TDS, Form 26AS, etc.), you may receive a notice.

b) Non-disclosure of assets: Failing to disclose assets or foreign income in your tax return can trigger an income tax notice.

c) High-value transactions: Engaging in high-value transactions without disclosing them in your tax return may attract a tax notice. These transactions could include large cash deposits, purchase of property or investments, etc.

d) Late filing or non-filing of returns: If you fail to file your tax returns on time or don’t file them at all, you may receive a notice from the tax department.

e) Claiming excessive deductions: If you claim deductions or exemptions that seem excessive or unrealistic compared to your income, the tax authorities may send a notice for further scrutiny.

f) Errors in tax returns: Mistakes like incorrect personal information, wrong calculations, or incorrect tax credits can lead to a tax notice.

It’s crucial to maintain accurate records, report all income and deductions correctly, and file tax returns on time to avoid receiving an income tax notice.

Below are the few top reasons that can get you income tax notice:

1. Discrepancies in Disclosure of Actual Income & Declared Income

2. Inaccurate Information on Assets or Income in The Income Tax Return

3. Unexpected Alters in Investment Amounts, Elevated Transactions or Income

4. Unexpected TDS Inconsistencies When Your TDS Claim Is Incorrect

5. For Review & Evaluation

6. Delayed Income Tax Return Filing

7. Payment of Refunds Against Any Outstanding Debts & Taxes Owed by You

8. For Prior Years of Tax Evasion

There can be many reasons why individuals may receive an income tax notice in India. Here are some of the top reasons:

1. If Income Tax Return is not filed on time.

2. If there is a mismatch in income reported by the individual and the information IT department has from Form 26AS

3. If income from all sources are not disclosed

4. If large cash deposits or investments are made which are not aligned with income, they may be flagged by the Income Tax Department.

5. Failure to declare any foreign account or investments made abroad

6. ITR filing mistakes can be highlighted asking the individuals to file revised returns.

Source: https://www.livemint.com/money/personal-finance/top-reasons-which-can-receive-you-an-income-tax-notice-11680086667640.html

© 2018 CA Chandan Agarwal. All rights reserved.