MUCH ADO ABOUT ‘A’ HOUSE: DECODING THE ‘ONE HOUSE’, ‘ONE UNIT’ CONCEPT IN SECTION 54F OF THE INCOME TAX ACT, 1961

MUCH ADO ABOUT ‘A’ HOUSE: DECODING THE ‘ONE HOUSE’, ‘ONE UNIT’ CONCEPT IN SECTION 54F OF THE INCOME TAX ACT, 1961

Introduction

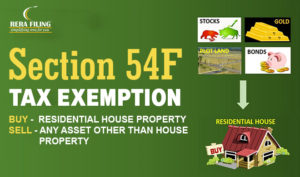

Sec 54F ‘Capital Gain on transfer of certain capital assets not to be charged in case of investment in residential house’, was introduced vide the Finance Act, 1982, w.e.f 01.04.1983. Way back in 1982, it was felt that there was a dearth of house owning and housing construction activities. To overcome this situation, this section was introduced with a vision that it would encourage people to invest in houses. The Budget Speech of Hon’ble Finance Minister for the year 1982 – 83 spells as under:

“88. There is an acute shortage of housing, and house building activity has to be given impetus. With a view to providing an incentive to taxpayers who do not own a residential house, I propose to exempt from tax long-term capital gains arising from the transfer of other assets where the net consideration is invested by the taxpayer in a residential house”.

Hence vide Finance Act, 1982, Sec 54F was introduced.

Read more on: https://taxguru.in/income-tax/decoding-one-house-one-unit-concept-section-54f.html

© 2018 CA Chandan Agarwal. All rights reserved.