Since we are in the midst of the tax-saving season, it is a good time to revisit your tax-saving strategy and ascertain which regime suits you the best

Since we are in the midst of the tax-saving season, it is a good time to revisit your tax-saving strategy and ascertain which regime suits you the best

Union Budget 2022 did not make any significant changes to the old tax regime and the new, alternative tax structure introduced in 2020. Finance Minister Nirmala Sitharaman emphasised on the importance of stability and predictability, which possibly means that the two regimes are here to stay in their current form for some time.

Budget 2022: The real reason why Budget 2022 kept income-tax rates and slabs steady

Introduced in Budget 2020, the new income-tax regime offers liberalized tax slabs with lower rates, but with fewer exemptions. The old, co-existing tax regime, is the one that offers various tax benefits such as tax-saver investments under Section 80C, health insurance premiums, house rent allowance (HRA) and so on. To choose between the two, you need to take into account your taxable income and tax breaks that you are eligible for every year. You also need to look at your investment habits, your age, life-stage, goals, responsibilities and likely expenses.

Since we are in the midst of the tax-saving season, it is a good time to revisit your tax-saving strategy and ascertain which regime suits you the best, depending on your profile.

Salaried in lower tax brackets, claiming fewer tax benefits

Now, let’s say your taxable income is Rs 6 lakh and you claim any other deduction such as term insurance premium, EPF contribution and so on under section 80C. In this case, the old tax regime will suit you better.

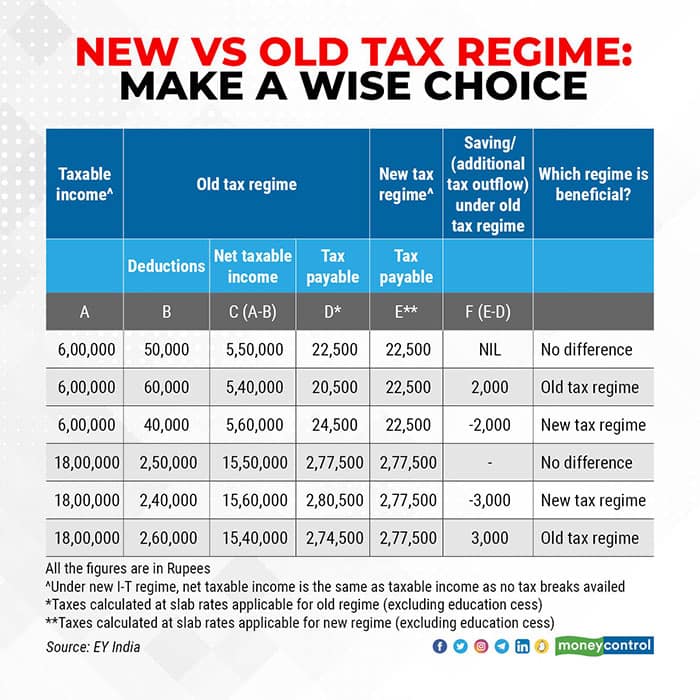

This is because standard deduction of Rs 50,000 is available to all salaried tax-payers by default under the old tax regime. Your contribution to EPF is mandatory and this, along with the standard deduction of Rs 50,000, tip the scales in old regime’s favour. “If the taxpayer’s income is Rs 6 lakh and the taxpayer is claiming deduction of Rs 50,000 under old tax regime, his tax payable under old tax regime and new tax regime will be same. However, if they are claiming deduction and/or exemptions of more than Rs 50,000, old tax regime will be beneficial to the taxpayer,” says Mayur Shah, Tax Partner, EY India.

Higher income slabs, availing of multiple tax breaks

Not all tax-saving strategies involve making an actual investment every year. Certain deductions are involuntary or recurring in nature. For example, employee’s EPF contribution, term insurance premiums, children’s school tuition fees and even home loan principal repayment. So, it is likely that you are already availing of tax breaks of over Rs 2.5 lakh. If your income is Rs 15 lakh and you are eligible for deductions of over Rs 2.5 lakh, again, you should stick to the old regime. If you have not maximised the tax benefits offered in the old, with-exemptions regime, try to do so before contemplating a switch to the new regime.

Freshers with little patience for paperwork

Under the new regime, around 70 tax sops (rebates / deductions / exemptions) are not available, such as house-rent allowance (HRA), Leave travel Allowance (LTA) or housing loan interest payment. “The new tax regime benefits new employees or youngsters who may not save in the initial years of their career. Or, those who have nothing to claim as deduction such living in their own accommodation, are not paying rent (no HRA) or are not contributing to provident fund,” says Kuldip Kumar, Partner, Price Waterhouse & Co LLP.

Not many in the younger age-groups need life insurance either. So, if you barely any tax breaks to claim and have no patience for the paperwork involved in making tax-saver investments or maintaining records, you could look at the new regime.

But do not sacrifice your savings

That doesn’t mean you shouldn’t save at all. You may not require all tax-saving investments, but you must start to save from the moment you earn your first salary. Options like Public Provident Fund (PPF) and tax-saving mutual funds. The latter comes with a 3-year lock-in. Both instruments qualify for Section 80C tax deduction benefits. Financial planners say that by nature, youngsters don’t save. But tax deductions and exemptions nudge people to save. But tax deductions and exemptions nudge people to save, so optimising tax benefits can add value to your overall financial plan.

Retirees with limited income and recurring expenses

In your silver years, liquidity is critical for paying your routine bills as also unexpected medical expenses that may crop up. Since all tax-saving instruments come with a lock-in period – the shortest being equity-linked saving schemes (ELSS funds) with three-year lock-in – new regime may work better in some cases. You need to take a call on the basis of your financial requirements every year.

Any tax-saving options made in your retirement years should be done carefully because you do not want to lock your money for longer tenures.

Is switching between old and new tax regimes allowed many times?

If you are a salaried individual, you can make this choice every year, even at the time of filing your income tax returns. For those with business income, things are a bit more complex – if you opt for the new regime, you can switch back to the old system only once. “Once new tax regime option is withdrawn, such individual or Hindu Undivided Family (HUF) will not be eligible to exercise the option of opting for new tax regime in future tax years,” says Mayur Shah.

Source: https://www.moneycontrol.com/news/business/personal-finance/how-to-choose-between-the-new-and-old-income-tax-regimes-8054961.html

© 2018 CA Chandan Agarwal. All rights reserved.