The thought of getting a Section 143 (1) income tax notice for wrong information provided in the income tax return (ITR) may make you worried. While it is a document that shows that the Income Tax (I-T) Department might have caught you on the wrong foot, you don’t need to panic about it. You just need to know the right procedure to deal with it. Know what you need to tell the taxman if you have received an income tax notice.

The thought of getting a Section 143 (1) income tax notice for wrong information provided in the income tax return (ITR) may make you worried. While it is a document that shows that the Income Tax (I-T) Department might have caught you on the wrong foot, you don’t need to panic about it. You just need to know the right procedure to deal with it. Know what you need to tell the taxman if you have received an income tax notice.

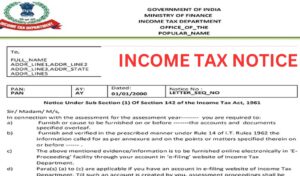

Income Tax Notice: When you are filing your income tax return (ITR), the first thing you want is tax rebate from the Income Tax (I-T) Department and the last thing you want from it is a Section 143 (1) Income Tax Notice. Though the current I-T Department website is quite user-friendly and shows calculations of the taxes you have to pay, it is quite a possibility that you would have fed the wrong information mistakenly in your ITR.

You didn’t realise your mistake then; you submitted it and ended up receiving Section 143 (1) Income Tax Notice.

While wrong information in ITR invites penalty from the taxman, receiving a notice doesn’t mean that you will surely be penalised.

You can reply to that notice constructively.

In this write-up, we will tell you how to deal with Section 143 (1) Income Tax Notice, which is also known as Letter of Intimation in ITR.

In the technical language of taxman, the income tax notice is known as Letter of Information.

The notice tells if tax information you have mentioned in your ITR is right or wrong.

The notice asks the taxpayer to make corrections in their ITR.

Whether your liability is more than the tax paid during the income tax return.

Whether your liability is less than the tax you have paid during the return.

One may receive such income tax notices till the time their returns has not been processed.

If you receive such a notice from the I-T department, don’t delay and reply it as soon as possible.

The tax notice under Section 143(1) is called ‘Notice of Demand’.

It means, if you have any outstanding tax liability, you should pay it within 20 days of receiving the notice.

If you delay your response and 30 days have passed, you will have to pay monthly interest at the rate of one per cent.

An income tax notice under Section 156 is issued against the outstanding dues, interest, penalty, etc.

Such notices are generally sent after post assessment of the income tax return.

The assessment officer issues this notice; gives instructions for the due amount; and asks the taxpayer to deposit the outstanding amount on time to avoid any penalty.

Source: https://www.zeebiz.com/personal-finance/income-tax/news-income-tax-return-itr-notice-what-to-do-if-you-receive-a-section-143-1-notice-from-the-taxman-income-tax-return-status-income-tax-refund-status-income-tax-login-271470

© 2018 CA Chandan Agarwal. All rights reserved.