Buy insurance not only to secure your life and health but also for associated tax benefits. Different insurance plans come with different benefits and hence investors must choose to buy them accordingly. Read further to know more

Buy insurance not only to secure your life and health but also for associated tax benefits. Different insurance plans come with different benefits and hence investors must choose to buy them accordingly. Read further to know more

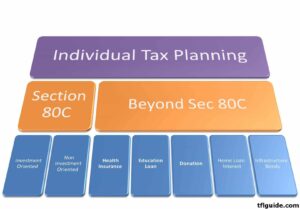

How many people start planning their investments early in their lives? How many among them decide their investments considering both the tenets of wealth creation and tax savings? A good financial plan planned and decided well in advance not only enables the accumulation of the much-needed corpus but also ensures adequate planning of taxes.

The idea behind investing money is to push yourself for increased savings and greater financial security. The benefits of investing come to the fore only during difficult times as the wealth created pays off the expenses while leaving enough for the future. Apart, these investment options also help in tax saving, thus, saving you from the hassle and embarrassment of planning your tax saving measures at the last minute. Investing in insurance products is one of the most popular ways to save money on taxes. Not only do they provide financial security, but they also provide significant tax benefits.

Assessing your financial position regularly will help you evaluate if you have chosen the right investment options that not only help you to get rich but also lower your tax liability. As opposed to traditional investment options like the public provident fund (PPF), the employees’ provident fund (EPF), tax-saving fixed deposits, National Savings Certificates (NSCs), equity-linked savings schemes (ELSS), and more, investors can earn desired amount while saving taxes through insurance products too.

Take, for example, Unit Linked Insurance Plans (ULIPs) that help earn returns to the tune of 12-15 per cent. To avail of the desired tax benefits, policyholders can claim tax deductions of up to ₹150,000 on the premiums paid under Section 80C of the Income Tax Act, 1961. The earnings from ULIPs are taxable as “Capital Gains”, in the hands of policyholders, irrespective of partial or complete withdrawal. However, the death proceeds will continue to be exempt from tax, thus, allowing policyholders’ families to benefit from both market-linked earnings and tax-exemption benefits.

Next in line are Guaranteed Return Plans that policyholders must consider for tax benefits under Section 80C and Section 10(10D) of the Income Tax Act. This explains why these plans are preferred over traditional plans including PPFs, FDs, and NSCs. The earnings generated are in the range of 6-7.2 per cent depending on the financial institution issuing the plan. Furthermore, these plans include insurance benefits and a life cover worth 10 times the annual premium, making it eligible for a tax rebate under Section 10(10D). Because of the life insurance component, it also provides tax benefits under Section 80C up to ₹1.50 lakh.

One cannot ignore how Term Insurance Plans are most preferred for their tax-saving benefits. Under Section 80C of the Income Tax Act, premiums paid for a term life insurance policy are tax deductible up to ₹1.50 lakhs. Not only that, but Section 10 (10D) of the benefits states that the payout received under this plan in the event of the policyholder’s death is completely tax-free.

Term insurance, as the name suggests, is a pure life insurance policy that financially protects the policyholder’s family. The idea behind buying this plan is to ensure a financial security tool to tackle a sudden financial crisis in the event of the policyholder’s untimely death. Investing in a term insurance policy provides financial security as well as much sought-after tax benefits.

Rising costs of medical treatment have forced many people to buy Health Insurance Plans. There are many kinds of health insurance policies available in the market. While some promise cashless health coverage, plans sold by some insurance companies in India compensate for the amount spent on treatment and subsequent medical expenses.

Section 80D of the Income Tax Act of 1961 provides for a tax exemption for policyholders. The policyholders can avail of tax deductions of up to ₹25,000 per fiscal year for themselves, their better halves, and dependent children if any. The insured can also claim an additional ₹25,000 deduction for medical insurancepremiums paid for non-senior parents, and ₹50,000 if one or both parents are seniors. This implies how tax exemptions add up to nearly Rs. 75,000 when purchasing health insurance plans for themselves and their parents.

Policyholders can opt for one or multiple policies depending on their financial goals and how they view investments in the future. Considering how one cannot ignore the impact of tax benefits on one’s intent to create wealth, policyholders cannot afford to ignore their importance. However, investors willing to include insurance plans in their portfolios must look into the terms and conditions detailed in the policy documents before deciding to pay for them.

Source: https://mintgenie.livemint.com/news/personal-finance/income-tax-planning-here-s-how-insurance-can-help-you-save-tax-151674069792254

© 2018 CA Chandan Agarwal. All rights reserved.