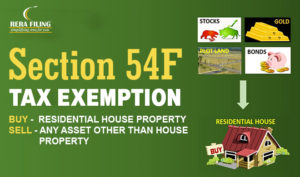

The Income Tax Appellate Tribunal (ITAT), Bangalore in a ruling has directed the Assessing Officer to grant an exemption to the assessee, under section 54F of the Income Tax Act, 1961, on the amount invested in the purchase of a residential house in his daughter’s name. Under Section 54F of the Income Tax Act, an individual after selling a residential property can avail tax exemption from Capital Gains if the capital gains are invested in the purchase or construction of a residential property, subject to certain conditions. In this case, the assessee claimed deduction Section 54F for the investment made in a residential property, in the name of his widowed daughter and was disallowed by the tax authorities until taken up by the ITAT.

The Income Tax Appellate Tribunal (ITAT), Bangalore in a ruling has directed the Assessing Officer to grant an exemption to the assessee, under section 54F of the Income Tax Act, 1961, on the amount invested in the purchase of a residential house in his daughter’s name. Under Section 54F of the Income Tax Act, an individual after selling a residential property can avail tax exemption from Capital Gains if the capital gains are invested in the purchase or construction of a residential property, subject to certain conditions. In this case, the assessee claimed deduction Section 54F for the investment made in a residential property, in the name of his widowed daughter and was disallowed by the tax authorities until taken up by the ITAT.

The facts of the case are that the assessee had sold property along with legal heirs for consideration of Rs.2,60,46,754. The assessee submitted before the assessing officer that the property under question was received by inheritance by way of partition. The legal heirs of the property are the assessee, his wife, son and widowed daughter.

The entire sale consideration received was invested in residential house property in the name of his widowed daughter. The assessee claimed deduction u/s 54F of the Act on the capital gains in his return but the assessing officer denied the claim of deduction and determined the total assessed income at Rs.2,07,75,230. The assessee claimed deduction u/s 54F of the Act for the investment made in a residential property, in the name of his widowed daughter.

However, it was contested that the sale consideration received by the assessee was invested in his widowed daughter on which the assessee claimed exemption u/s. 54F of the Act which is not permitted. The investment was to be made in the name of the assessee himself, not in the name of his widowed daughter.

The judicial members stated that as a matter of fact, Section 54F of the Act in terms does not require that the new residential property shall be purchased in the name of the assessee, it merely says that the assessee should have purchased/constructed a residential house. Also, since the provisions permit economic growth has to be interpreted liberally, restriction on it too has to be construed so as to advance the objective of the provisions not to frustrate it.

Accordingly, judicial members of ITAT were of the opinion that the assessee has invested the sale consideration on transfer of Capital Asset in purchasing a new residential property in the name of the widowed dependent daughter of the assessee and also the legal heir of the assessee. The assessee’s widowed daughter is having no independent source of income and is fully dependent on the assessee after the death of her husband. Accordingly, they directed the Assessing Officer to grant exemption u/s. 54F of the Act on the amount invested in the purchase of a residential house in his daughter’s name.

Source: https://www.financialexpress.com/money/income-tax/itat-grants-exemption-on-amount-invested-in-purchase-of-residential-house-in-daughters-name/2203979/

© 2018 CA Chandan Agarwal. All rights reserved.