Section 80TTB of the Income Tax Act provides tax deductions to senior citizens on income earned from interest on deposits held with banks, post offices and cooperative societies. It allows a deduction of up to ₹50,000 from the total income of such individuals.

Section 80TTB of the Income Tax Act provides tax deductions to senior citizens on income earned from interest on deposits held with banks, post offices and cooperative societies. It allows a deduction of up to ₹50,000 from the total income of such individuals.

As people age, they may find themselves facing a new set of financial challenges. For senior citizens, retirement brings with it the need to adjust their finances as their income and expenses change. To ensure that they can maintain a comfortable lifestyle in retirement, it’s essential for them to have access to resources that will help them manage their money efficiently.

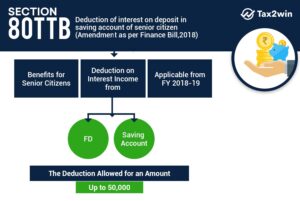

Section 80TTB of the Income Tax Act, 1961, introduced by the Finance Act 2019, provides certain benefits to senior citizens in the form of tax deductions. It allows them to claim a deduction of up to ₹50,000 on their income from interest earned on deposits held with banks, post offices, and cooperative societies.

Let us understand it in detail.

Section 80TTB of the Income Tax Act governs the tax deductions available for senior citizens on the income earned from interest on deposits held with banks, post offices and cooperative societies. It is applicable to individuals who are aged 60 years or above and provides a deduction of up to ₹50,000 from the total income of such individuals.

This deduction is available only for the income that is taxable under the head “Income from other sources”. This section is beneficial for senior citizens who are unable to earn any other income or have limited other sources of income.

It is important to remember that interest received on savings accounts and fixed or recurring deposits kept with the aforementioned three sources will be taken into account for tax deduction purposes.

However, interest from corporate FDs and other schemes is not eligible for the aforementioned deduction. Bond and debenture interests is also not eligible for the deduction provided for in this section.

Section 80TTB and Section 80TTA are both sections of the Income Tax Act, 1961. Section 80TTB provides a deduction of up to ₹50,000 on income from interest on deposits held in any account by senior citizens (i.e., persons above the age of 60). Furthermore, this deduction can be claimed irrespective of whether the individual is filing taxes or not.

On the other hand, Section 80TTA is applicable to all taxpayers, regardless of their age. It allows a deduction of up to ₹10,000 for interest earned on deposits held in savings accounts with banks, cooperative societies and post offices. This deduction can only be claimed when the individual is filing taxes. The key difference between section 80TTB and section 80TTA is that the former is available to only senior citizens whereas the latter is available to all taxpayers.

When submitting your IT returns, you can quickly compute your deduction under Section 80TTB. To start, figure out the interest you received on savings accounts, fixed deposits, recurring deposits, etc. for a specific fiscal year. These details must be entered under the “Income from other sources” category. If you choose Section 80TTB under deductions, your taxable income calculation would be directly lowered by Rs. 50,000.

Source: https://mintgenie.livemint.com/news/personal-finance/income-tax-section-80ttb-deductions-and-eligibility-for-senior-citizens-explained-151674115547119

© 2018 CA Chandan Agarwal. All rights reserved.